How to find your enough number

A few simple calculations could save you from a life of regret.

The hardest financial skill is getting the goalpost to stop moving. — Morgan Housel, The Psychology of Money

There's something attractive about counter-cultural goals. In a world that is ever-shouting more, faster, bigger — it feels right, in a way, to move towards the opposites.

- An audience of a few thousand instead of millions.

- A life lived at a sustainable pace instead of racing towards a constantly moving finish line.

- Financial goals aligned with what we actually need to live the lives we want.

But I didn't always think this way.

A lot of people fall into the trap of running towards more simply because that's the direction they see everyone else heading in.

More is not a bad thing, but it's often a distraction. We acquire money so that we can have and do what we want. This includes basic needs like food and shelter, but also the things that fulfill us like adventure, self-development, and relationships.

Money is helpful insomuch as it enables us to do and have those things. But when the pursuit of money inhibits any of those, when it evolves into a status-seeking competition with others... Well, that's when we must admit we've gone off track.

Pursuing a better life doesn't need to come at the cost of the one you have right now.

The benefit of an enough number

“Enough” is not too little. — Morgan Housel

An enough number is a financial amount in which your needs and most important wants are met.

As Housel points out, the number shouldn't be something we grimace to accept. It should feel right. It shouldn't bring anxiety when we look at it, and it shouldn't feel miles out of reach.

Once calculated, the number becomes a sort of filter for various life decisions by helping us ask better questions.

- Should I take this higher-paying job? If I already have my enough number with my current job, what non-financial rewards do I stand to gain from the change?

- I see my circles of influence buying second homes or nicer cars, is it time to upgrade? How would making these changes influence my enough number? Do I want to upend my lifestyle in order to be able to afford these comfortably?

Personal finance is emotional. We can hack our way through budget spreadsheets and Dave Ramsey commentary all day long only to overspend on a fancy dinner because we deserve it.

An enough number eliminates the guilt trips by giving us control over how and why we spend our money. It's not a limitation imposed on us, but rather a boundary we've erected for our own happiness.

If we don't decide what is enough for us, the world will convince us such a number doesn't exist.

How to calculate your enough number

Before we dive into the number crunching, here are a few ideas that have helped me find and hold onto my number.

- Your first enough number should be based on your current needs and wants. We can't predict what tomorrow will bring, let alone what our life will look like in 10, 20, or 30 years.

- Resist the urge to be vague. Figure out exactly what you're spending now month-to-month, categorize it, and then use that as a starting point.

- Your enough number can change. Housel's first quote about getting the goalpost to stop moving is essential. But, we're not static creatures. What's enough when we're single may change once we're married, and again if we decide to have children, and again if life circumstances change. The goal is to never want/need more — the goal is to stop making more our default.

Step 1: List out all of the categories you currently spend in and their amounts.

Some of the categories and amounts we use are:

- Housing which includes mortgage, utilities, insurance, security system: $1,300

- Transportation: $500

- Food: $500

- Clothing: $100

- Entertainment: $300

- Pets: $150

- Travel: $0

- Education: $250

- Investments: $1,000

- Giving: $120

- Miscellaneous: $500

Current total: $4,720

Step 2: Add any categories you want and adjust any of the financial amounts to what you would like them to be.

- Housing: $1,300

- Housing projects and upgrades: $500 (approximate monthly cost to finish basement and garage)

- Transportation: $1,000 (add second car)

- Food: $500

- Clothing: $100

- Entertainment: $500

- Pets: $150

- Travel: $1,000 (two longer [2 week+] trips per years)

- Education: $250

- Investments: $2,000 (this will allow for us to take mini-retirements throughout our career)

- Giving: $500

- Miscellaneous: +20% (my ideal discretionary spend would be a 20% monthly buffer of the above amount [$7,800])

Updated total: $9,360

As you can see, any category I added or amount I increased was paired with a clear reason.

For housing, we want to increase that budget we have so that we can tackle specific projects that will improve our quality of life. A finished basement will give us more space to entertain and host monthly board game nights, something our current living room is too small to do.

The same goes for transportation, travel, and investments. Bre and I have had many conversations about all of these and taken the time to calculate exactly what we would need to make them a reality.

You won't get what you want until you're specific about what that is.

Step 3: Now calculate what annual salary would give you grant you that monthly expenditure.

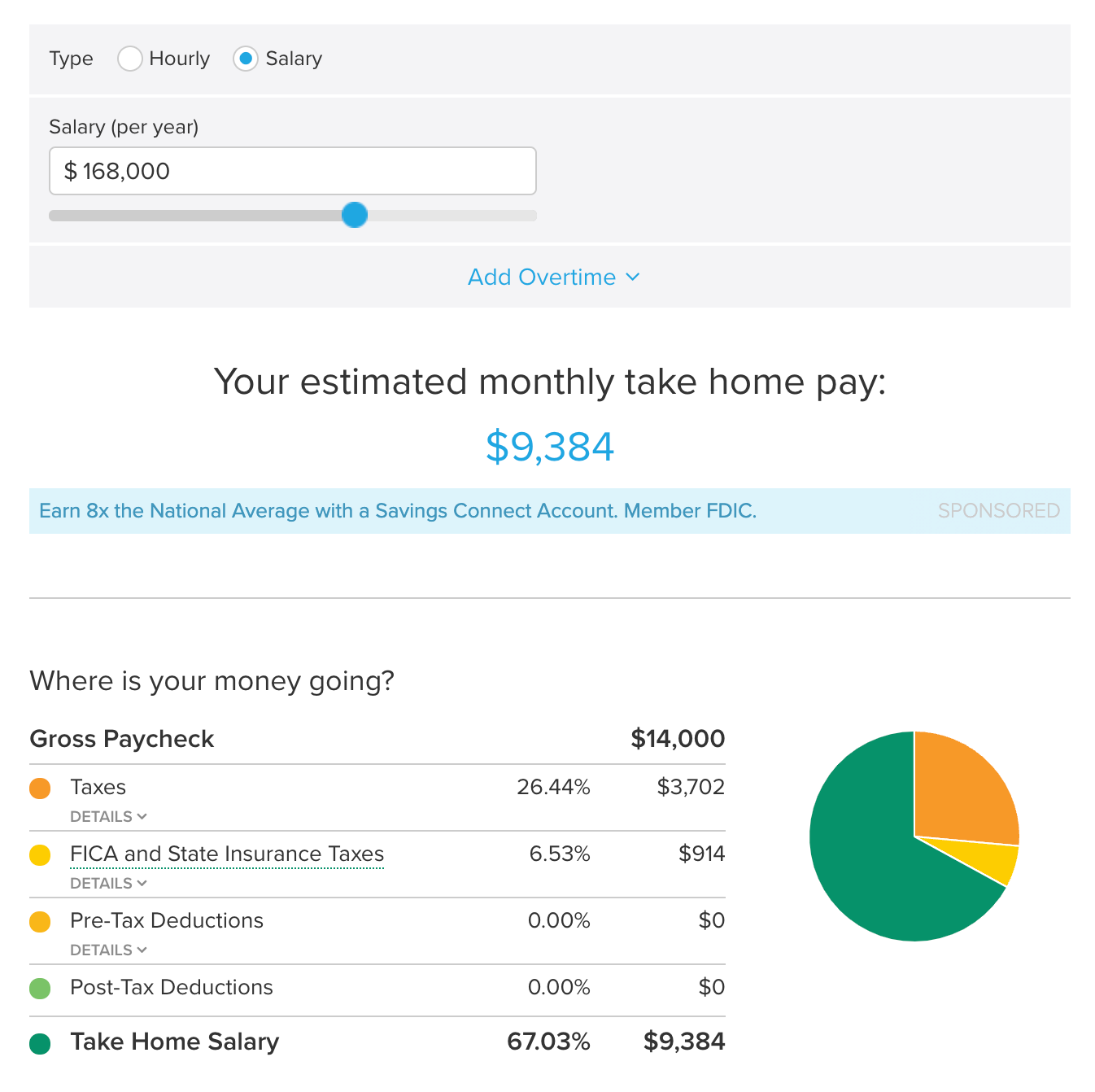

I like Smart Asset's calculator tools, although they are US-specific.

I changed the settings to Monthly - Pay frequency, then used the slider to find a take-home pay that met or exceeded the number from Step 2.

As you can see below, a gross income of approximately $168,000 would cover all of the listed categories.

Now, the benefit of being in a relationship is that we can split that number between two earners for a goal of $84,000 each.

Although that number is more than we make now, it's not that far off. Plus, as we continue in our careers, it's a number we'll easily surpass as we gain more skills and experience.

So, over time, salary will become less of a deciding factor in the work we pursue because of our enough figure.

What does your number look like?

Depending on who you are and how you grew up, our number might seem very low or very high.

If we wanted to pursue a more nomadic lifestyle, we could sell our house and car and immediately reduce our monthly spending by 30%.

If our goal was to move to New York City and eat at the best restaurants every week, we'd need to double our number (at least!).

It's all relative. Contextual.

It's okay for your finances to be personal. Earning more just for the sake of it isn't that impressive anymore, at least to the people who should matter.

Take the time to crunch your own numbers. We're they higher or lower than you thought? Are they based on what you authentically want for your life? Or on the things you've been told to aim for?

I hope you see the power in enoughness and allow it to help you build a life you're proud of. Happiness is the ultimate flex.